Resolv just joined the buyback club.

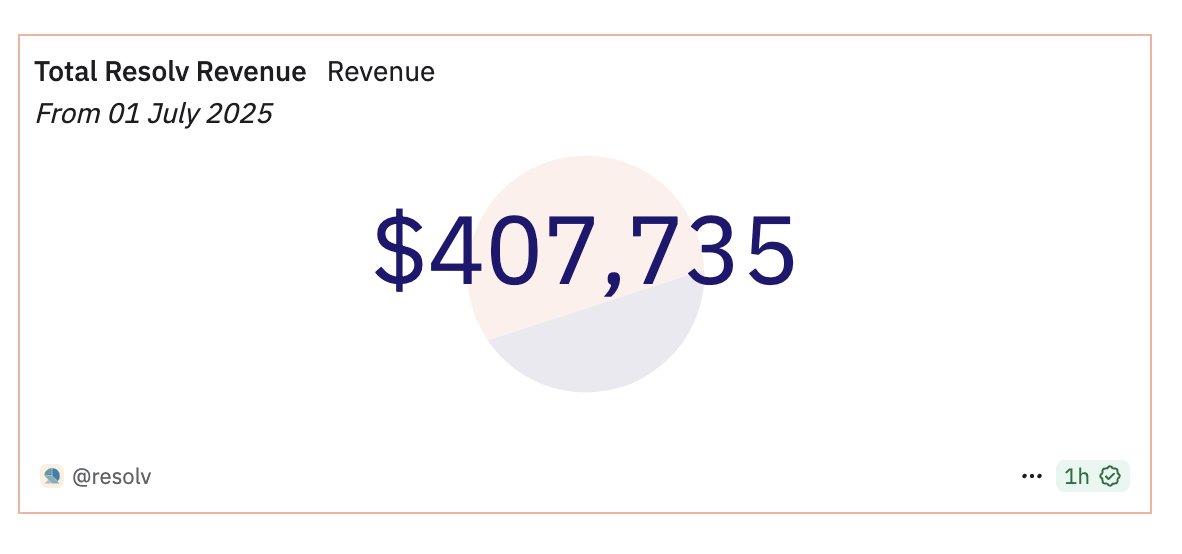

Since the August fee switch, Resolv generated $400k+ in revenue (annualizing to $7.3M), from collateral yields, partner incentives, and integrations.

Meanwhile, Resolv Foundation generated $226k in core fees and has spent $170k to buy ~1M $RESOLV at ~$0.16. Buybacks will continue weekly, starting with 75% of core fees.

The fee switch ramped from 2.5% to 10%, to capture a bigger portion of daily profits for treasury use, adoption incentives, and buybacks.

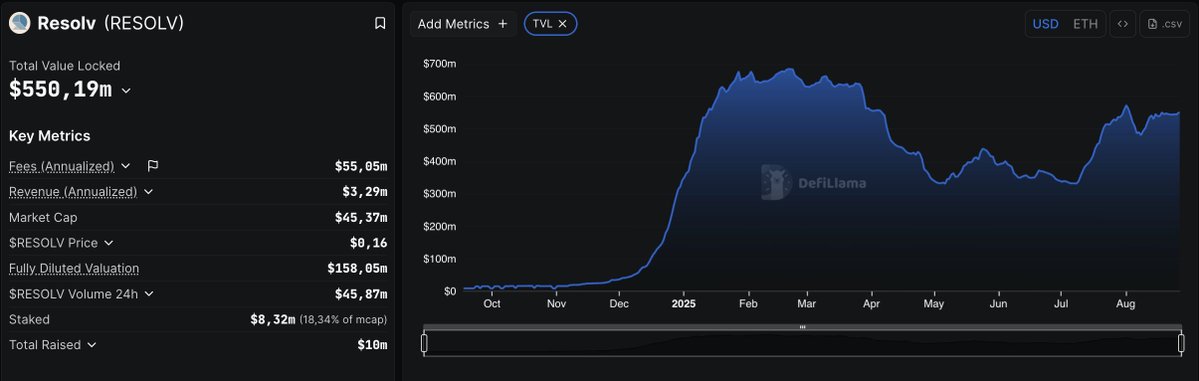

Current metrics:

- TVL: $540M (2x since TGE)

- Market Cap: ~$45M → 0.09x TVL (vs Ethena’s 0.33–0.5x)

- $stUSR (9% APR) and $RLP (12.9% APR) - both are post-fee, real yields from delta-neutral strategies.

The valuation gap is hard to ignore given Resolv’s positive cash flow and accelerating TVL.

Resolv Foundation has launched a buyback program, with the first allocation set at 75% of core protocol fees.

Each week, a portion of fees will be allocated to open-market purchases of $RESOLV, with tokens moved to Foundation reserves and taken out of circulation.

4.55K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.