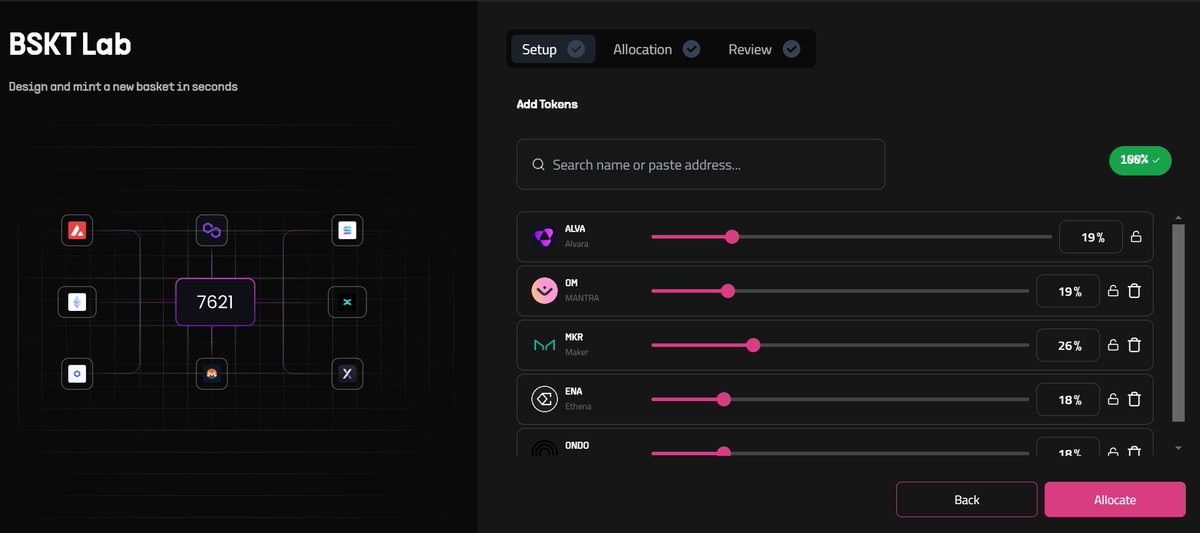

In fact, this year the RWA sector is more diversified. Whether it's bringing US stocks on-chain or tokenizing valuable traditional industries, we need to think clearly behind the excitement. Everyone is currently focused on single-point breakthroughs. Mavryk exploded in popularity with 10 billion in real estate on-chain, while $Plume and Novastro are also fixated on certain types of assets. However, simply moving a single asset on-chain is essentially just storing assets in a different place, and it will eventually be replaced. Where are the real opportunities? Someone needs to combine different RWAs together. Whether it's real estate, bonds, or gold, they should all be standardized so that they can be easily transferred and matched in DeFi, allowing ordinary people to assemble an on-chain asset portfolio in just a few minutes, just like buying ETH. This is the most interesting aspect of @AlvaraProtocol: it doesn't compete for a single large business but aims to be the total entry...

Show original

39.67K

160

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.